Trading accounts at ICMarkets

ICMarkets is originally a ECN forex broker, and the customer segment that ICMarkets wants to target is professional traders, trading with a large volume, so ICMarkets does not have many types of accounts for traders to choose. In addition, the account types at ICMarkets is somewhat similar to Exness, designed based on the trading platform that the ICMarkets offers. So basically, ICMarkets has 3 main types of accounts including: Standard accounts; Raw Spread account (compatible with MT4 and MT5 software); Raw Spread account (compatible with cTrader software).

Basic information about Standard account provided by ICMarkets:

- Minimum deposit: 200 USD

- Maximum leverage: 1: 500

- Commission fee: no

- Difference from: 1 pip

- Forex currency: 64 pairs

Basic information about Raw Spread account (Compatible with MT4 and MT5)

- Minimum deposit: 200 USD

- Maximum leverage: 1:500

- Commission fee: fixed 7 USD/lot -way lot

- Difference from: 0.0 pip

- Forex currency: 64 pairs

- Suitable for traders who like EA and scalping

Basic information about Raw Spread (Compatible with cTrader)

- Minimum deposit: 200 USD

- Maximum leverage: 1:500

- Commission fee: for 6 USD/2-way lot

- Difference from: 0.0 pip

- Forex currency: 64 pairs

- Suitable for traders who like scalping and day trader

Thus, if you look at the information above, you will see that the 3 types of accounts provided by ICMarkets are not too different in terms of leverage, minimum deposit, trading products ...

But in fact they differ a lot in the nature of the account. If the Standard account is often referred to as STP / ECN, the remaining 2 types of ICMarkets accounts include Raw Spread (compatible with MT4 and MT5 software); Raw Spread accounts (compatible with cTrader software) are considered as True ECN accounts. Importantly, ICMarkets is actually one of the forex brokers now providing "real" ECN accounts for traders.

So, what is the ECN account provided by ICMarkets?

ECN, which stands for Electronic Communication Network, is a technical term used to describe how banks and liquidity providers connect to each other to give BID and ASK prices.

Accordingly, the brokers will look for partners who are Tier 1 liquidity providers (something that traders should have done by themselves, then choose, but it will take a lot of time, so the broker will do this job to help traders).

When a trader places an order, the order will be routed directly into the market without going through the trading desks (Dealing Desk), or the broker will proceed themselves the above orders, means directly interfering with the traders’ order. As a result, traders can enjoy better prices, ensure faster execution speed, no requotes. Most importantly, brokers and traders do not have a conflict of interest, so there will be no brokers searching for tricks, intervention or change spreads to profiteering traders. And because the order is routed directly into the market, the broker will mainly get the commission from traders, which is also considered as the main benefit of ECN brokers in general and ICMarkets in particular.

Currently, 2 types of Raw Markets accounts of IC Markets are built through a supply of prices from over 25 banks, investment funds, insurance funds and various sources of underground liquidity, with a system that has been called Raw Pricing, with Execution Priority (ESP) rates sent from the pricing provider to ICMarkets to the broker's trading system where customers can trade without a desk, price manipulation or re-quote.

In addition to the Raw Pricing mechanism, because it is an ECN account, the trading orders made at ICMarkets are not requote again (the phenomenon that orders are not being matched at the price traders want, usually occurs when the market fluctuates dramatically, until the order is matched, the price will be different from the price the trader needs, resulting in a loss, which is common with market maker brokers. In order to do so, it is thanks to the data processing system sponsored by ICMarkets located at Equinix IBX NY4 and LD5 Data Centers in New York and London, which is considered as the largest connected data center in the world.

Equinix customers are all big names in the financial industry such as Chicago Board Options Exchange, Bats, ICAP, Nasdaq; The New York Stock Exchange and Bloomberg LP and of course including ICMarkets.

By hosting the MetaTrader 4 and 5 servers at NY4, it allows ICMarkets to cross-connect between the MetaTrader server and all IC Markets pricing providers. As a result, it will provide the lowest latency possible, ensuring the fastest matching speed for traders, according to ICMarkets, the average time to execute orders from the time the transaction is received, processed until order confirmation and execute orders at ICMarkets in just 36.5 milliseconds!

Therefore, if you want to enjoy the best price regime at ICMarkets, with deep liquidity mechanism, we recommend you to choose one of the two types of Raw Spread accounts (for MetaTrader and cTrader) that ICMarkets offers.

However, the Raw Spread compatible with cTrader software is probably still too new to many traders, so you can research and choose Raw Spread for MT4 and MT5 software. This is also the most common account type traded at ICMarkets. In addition to the advantages regarding the nature of the account, the Raw Spread account types also attract traders by attractive spreads, which we will discuss in more detail later.

Trading platform provided by ICMarkets

One of the most appreciated aspectss at ICMarkets is that it provides all 3 platforms from the most popular and advanced today: MT4 software, MT5 software and cTrader.

MT4 and MT5 software provided by ICMarkets

Advantages of MT4 and MT5 software provided by ICMarkets:

- Friendly easy to use

- Low spread

- Super fast execution

Basically, all brokers provide MT4 trading platform, for some top brokers, they propose MT5 platform that is often used for stocks, in ICMarkets, MT5 is also mainly used for this purpose.

However, perhaps because of that, many people do not see the difference of MT4 software in different brokers, often seen as a tool to place orders, cut losses, and take profits but almost never exploit other features of this software.

MT4 and MT5 are essentially customized software, so depending on each platform will provide or offer a variety of tools to help traders achieve the highest trading efficiency. Therefore, try to understand the broker features provided when using MT4 and MT5.

ICMarkets also integrates with many tools or software for traders to conveniently use.

Features MT4 and MT5 provided by ICMarkets:

- Autochartist

- Indicators from Trading Central

- MultiTerminal

Correlation Matrix: Provide traders with market information about different time periods and allow them to make better decisions. You can see the information carefully here.

Alarm Manager: An individual trading support software can notify traders or even their followers on social media. You can see more here.

Sentiment Trader: Psychological indicators based on real open positions: the number of traders currently buying or selling. You can see more here.

Stealth Orders: This application allows traders to hide their pending orders from other market participants with more features. You can see more here.

Tick Chart Trader: Display various stick charts, including traditional line charts, timed stick charts, and stick bars / candles You can see more here.

These are just some of the advanced features provided by ICMarkets, and many other interesting features you can see here.

In the context of this article, we will introduce you to 3 features ICMarkets provides that many traders often overlook, although they are extremely useful: Autochartist feature, Signals from Trading Central and MultiTerminal.

Autochartist

We have to say this is a great feature to help you detect price models quickly. At ICMarkets, Autochartist supports both MT4 and MT5 software. In addition, Autochartist also supports fast finding Fibonacci, important resistance support levels or even indices.

In the past, Autochartist users had to pay a fee. However, at ICMarkets this tool is free, right after registering an account, in the trading section you choose the category "market prediction," enter the registration email, the session you want to receive notifications, or you can select all 3 sessions, then press Subscribe. When it comes to the sessions you subscribe, if a currency pair pattern is detected, you will receive an email notification.

In addition, if you want to see more models, you can access the bottom of the image on the Autochartist Web App, where ICMarkets will link to the Autochartist website for users to take a closer look.

Indicators from Trading Central

Trading Central must be a familiar name to many traders, because it is considered as a technical resource, providing investment research for many banks in the world. It is certified by 3 Independent Research Service Providers associations: Investoride Research, Euro IRP and Asia IRP.

In particular, Trading Central's approach is based on chart analysis to assess trends. This will be an extremely useful reference source for new traders to improve their own analytical capabilities.

In addition to technical strategies, Trading Central provides professional data analysis reports on forex currencies, commodities and indices via market data terminals such as Bloomberg, Thomson Reuters or Dow Jones, etc. Each trading product strategy is updated 10 times / day so almost every session has value information for your reference.

As mentioned, if you spend a lot of time on Telegram, go to Facebook groups, or go to Tradingview to find value information, you can refer directly from Trading Central, an extremely reputable analytical source, which normally will have to pay fee can be used. However, ICMarkets has supported their traders so all are free.

Usage instruction for Trading Central at ICMarkets

All of these features are only available when the account has been successfully activated by ICMarkets.

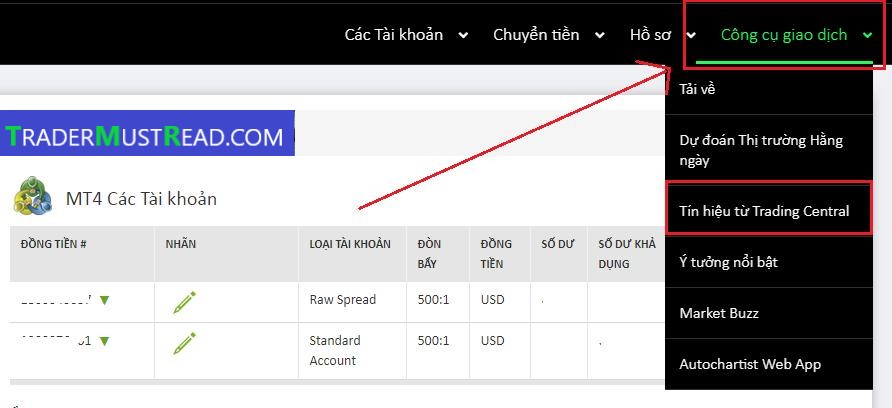

Then you just need to log in, then navigate to the "trading tools" section, followed by the "Ideas from Trading Central":

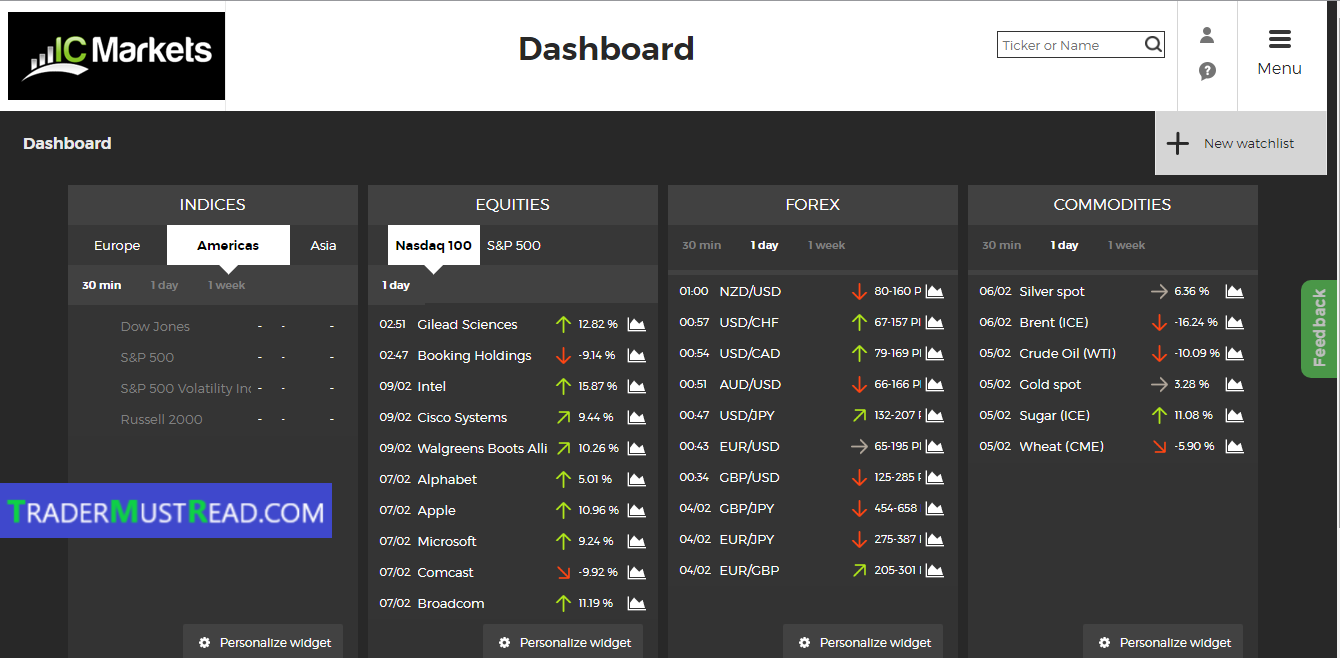

Click here, ICMarkets will also link directly to the homepage of Trading Central with the interface as below:

The main interface will provide data reporting in four main product categories, including: Indices (indicators); Equities (stocks); Forex and Commodities (commodities) with data frames divided by 30 minutes, 1 day or 1 week. If you want to see what products, you click on that product, as well as select the time frame you want to analyze.

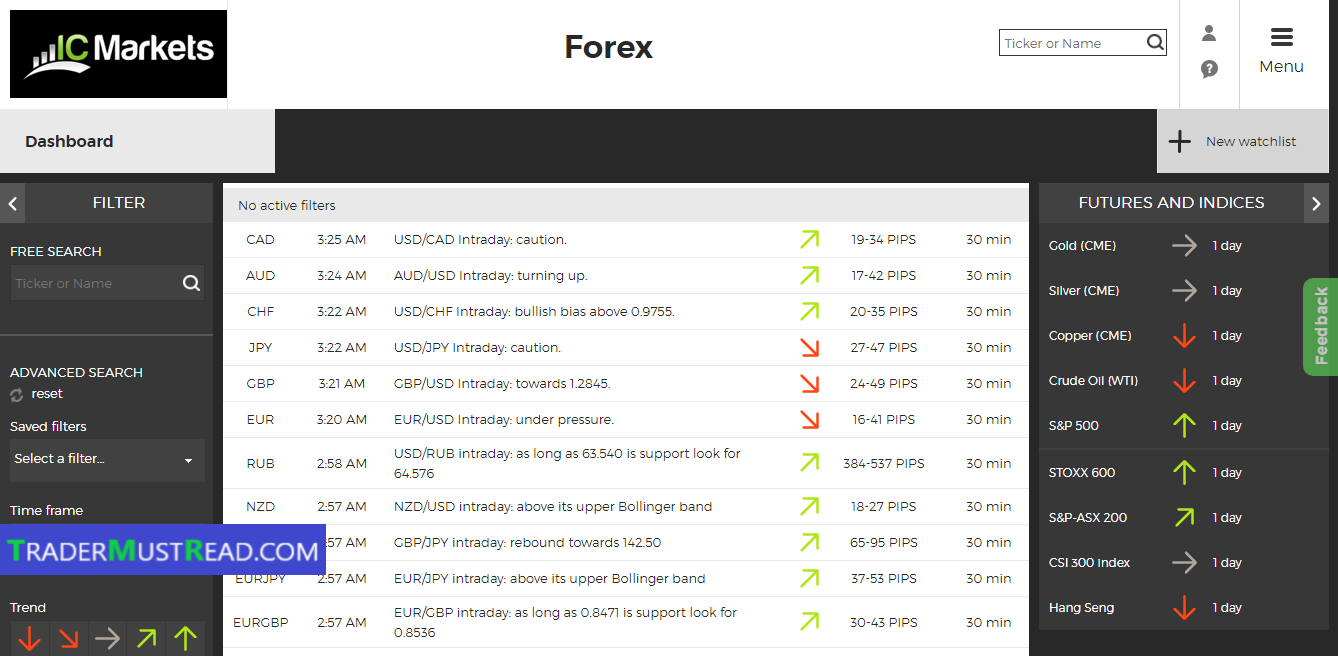

Here, we have clicked on the Forex list, will display all the analysis updated in real time for your reference:

Here, we have clicked on the Forex list, will display all the analysis updated in real time for your reference:

.png)

And if you click on a currency pair, there will be a trend analysis chart, resistance support points, time frame trends, reversal candlestick patterns, applied indicators, and the reason why this currency pair is analyzed as showed.

These analyses are too thorough, methodical and logical than a lot of suggestion you spend money to buy on Telegram or Facebook. At ICMarkets, all are free, so why not try to add a reliable source of your technical analysis for your reference?

MultiTerminal

This is the feature to manage multiple accounts at the same time,in reality, when trading, the number of accounts a trader opens, is usually greater than 1. Therefore, using MultiTerminal will help easily manage the entire order executions, open positions or the market price at the same time.

It should be noted: Trading Central and MultiTerminal features provided by ICMarkets are only available on MT4 software, will not be available on MT5. Particularly Autochartist are integrated by ICMarkets for both MT4 and MT5.

Thus, it can be seen that MT4 software is much favored by ICMarkets, right? However, if you want to trade stocks, MT5 software must be installed.

cTrader

If the MT4 and MT5 trading platforms were created by a Russian-based company, cTrader is owned by Spotware from the United Kingdom. This is the only software for forex ECN brokers. So if any broker integrates cTrader, then you can be completely assured that it is not a dealing desk or a market maker. Thus, the broker will not be able to change the spread to get more fee from traders.

However, cTrader is still a later developed platform compared to MT4, so there are not many indicators or integration of EA forms for traders. Therefore, cTrader is not for new traders.

But if you are an experienced trader, try using cTrader because there are many more improvements and updates such as:

- There is no need to turn on your device 24/24 if you set the trailing stop format as MT4.

- Profit-taking and partial-loss losses can be set. MT4 currently cannot do this.

- In addition, cTrader is a platform specifically for ECN brokers, so they also provide some specialized features such as VWAP and market depth.

At ICMarkets, the servers are also located at the LD5 IBX Equinix Data Center in London, known as the financial ecosystem, where more than 600 companies buy and sell, exchange, place of transactions, market data and service provider. This server is connected to the ICMarkets trading system to ensure extremely low latency and super fast execution, according to ICMarkets, it only takes a few microseconds for a matched order.

In addition to ICMarkets, there are many other reputable forex brokers that are also offering cTrader to their clients. To know which brokers uses cTrader, you can read more here.

Basic features of cTrader provided by ICMarket:

- Real time forex and CFD quotes

- Market leading spreads and low commissions

- Server at LD5 Data Center IBX Equinix

- Minimum lot size from 0.01 lot

- Flexible deposit and withdrawal options

- Class II pricing with full market depth

- There are no restrictions on limit orders

- Many types of orders

- The chart is detachable

- Show extended icon

- Real-time reporting

- Trade with just one click

CAlgo feature provided by ICMarkets

In fact, although it is a new software, cTrader is being developed with a lot of different features such as cAlgo, cBroker, cMirror and cXchange. Currently, cTrader of ICMarkets only supports cAlgo feature, the remaining features may be developed in the near future.

cAlgo is a feature that helps you automatically write custom indicators, automated strategy programs (cBots) as well as indicators dedicated to analyzing price trends. So basically, cAlgo is an automated trading form for traders.

By using C # language, traders can easily access to create EA for themselves. In addition, this is also a suggestion for traders who have both forex knowledge and IT knowledge to think about writing automated robots and reselling to traders who are in need, a form of forex investment which is even more attractive than forex trading itself

MAM / PAMM software provided by ICMarkets

IC Markets Multi-Account management software allows you to manage your clients' money with flexible allocation and real-time reporting on performance and commissions.

If the MAM account connects all attribute settings directly to the IC Markets MetaTrader 4 server by the percentage allocation method, then the PAMM account provides transaction allocation and risk adjustment for each sub-accounts based on customer risk profiles in a more flexible way. There are two types of allocations provided by ICMarkets: Balance-based Percentage and Capital-Percentage.

Please also note that MAM and PAMM can cause many traders to mistake for copy trade services. ICMarkets has partnered with MyFXBook to provide AutoTrade services to customers owned and operated by Myfxbook, but currently ICMarkets does not provide this service.

If you want to open an account, please click on the below:

CREATE YOUR ACCOUNT