What types of accounts is XM offering?

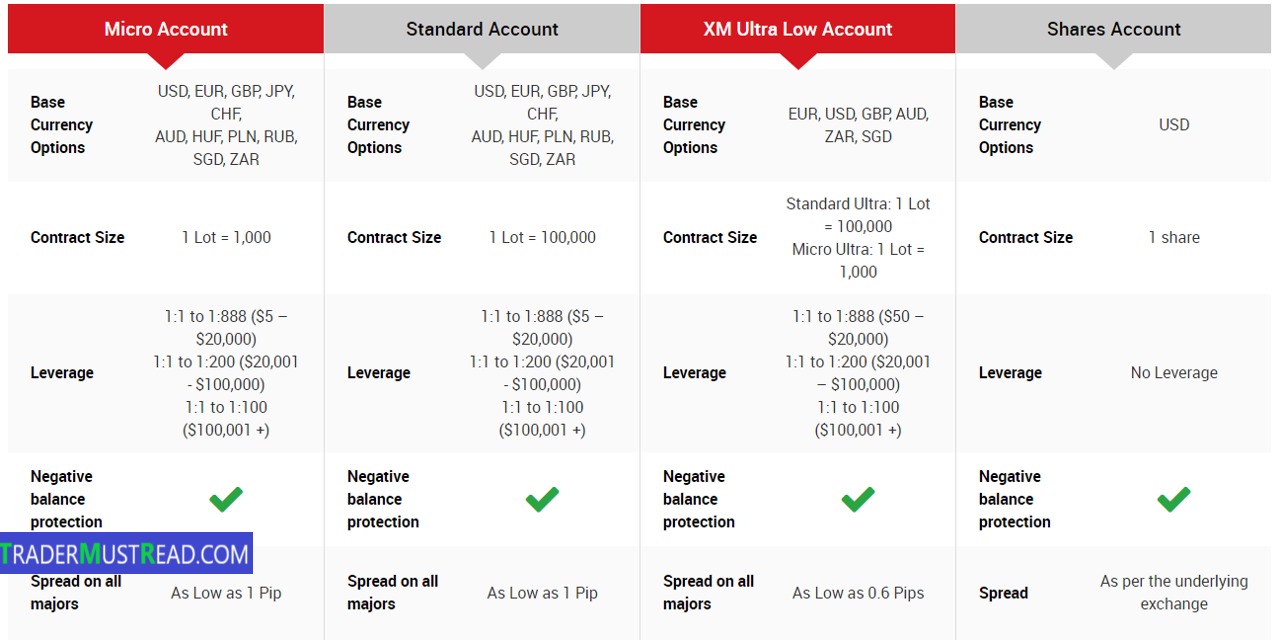

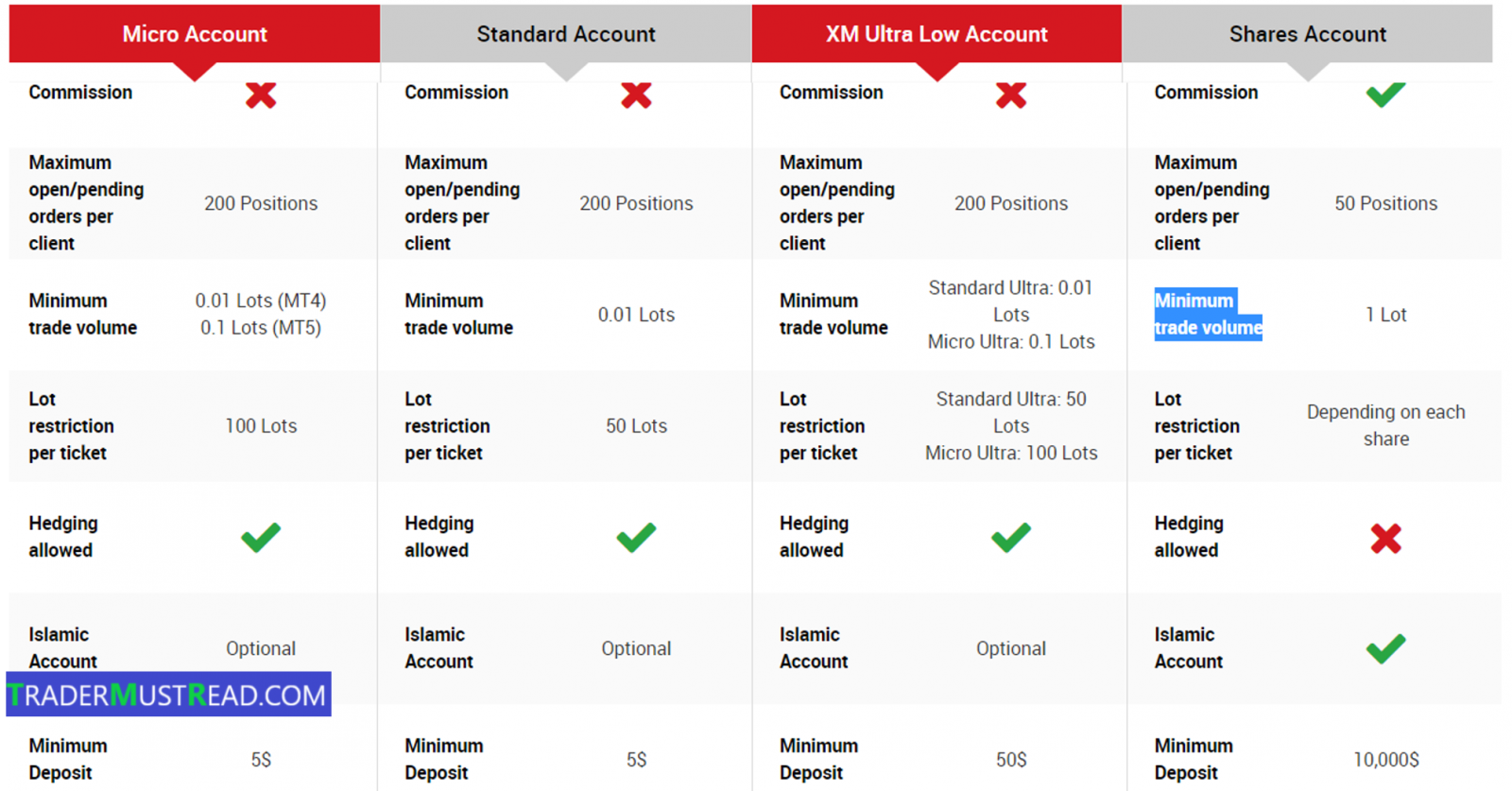

XM is providing 4 trading account types: Micro, Standard, Ultra Low and Share.

Lets together see what XM can provide following each type of account.

Micro Account: what are key things we need to focus.

- Minimal deposit: 5$

- Spread: From 1 Pip

- Commission: No

- Maximum open/pending orders per client: 200 positions

- Minimum trade volume: 0.01 Lots (MT4), 0.1 Lots (MT5)

- Hedging allowed: Yes

Micro account is intendedly served for new traders. So it is similar to Cent account on Exness or FBS.

However, there is a difference that it is calculated by Micro Lot (equivalent to 1 lot = 1.000 units instead of 1 lot = 100.000 units as other standard lot). Therefore, although the balance is still showed as USD, but due to smaller trading volume lot, 1 lot in Micro account will only be equivalent to 0.01 lot on Standard account, so still helps traders manage risk in any cases. In general, Micro account is the most suitable for new traders, who are still learning about forex trading.

What is Standard account of XM proving?

- Minimal deposit: 5$

- Spread: Chỉ từ 1 Pip

- Commission: Không

- Maximum open/pending orders per client: 200 positions

- Minimum trade volume: 0.01 lot

- Hedging allowed: Yes

This account type is quite similar to Micro account, but trading volume will be in lot and minimal deposit will be from only 5 USD, spread from 1 pip and XM is also proving maximum leverage 1:888. Both Micro and Standard accounts are designed for fresh traders, or still want to trade at small volume for practicing, so XM wants to provide the most suitable tool based on their trading need.

What is XM Ultra Low providing?

- Spread for major currencies: Only from 0,6 Pip

- Commission: No

- Maximum open/pending orders per client: 200 positions

- Minimal deposit: 50$

This account has lowest spread, only from 0.6 pip, and no commission applied, very low minimal deposit, according to XM policy, only from 50 USD. So it is undisputable that it is the trading account for the majority of traders, especially for traders who enjoy swing trading.

Why does XM have this account? You may have asked this question. It is for attracting traders, and competing with ECN brokers or credible brokers such as ICMarkets or Exness. Although there are lot of good benefits, there is no commission applied for Ultra Low account, a very outstanding advantage for those who want to trade at XM.

Trading friends, a aside note that XM is dividing Ultra Low account into 2 types: XM Ultra Low Standard and XM Ultra Low Micro, they are mainly different on trading volume and all other conditions are still the same.

What is Share account of XM providing?

- Base Currency Options: USD

- Leverage: No

- Spread: As per the underlying exchange

- Commission: Yes

- Maximum open/pending orders per client: 50 positions

- Minimum trade volume: 1 lot

- Minimal deposit: 10,000$

Share account will be for traders who like to trade stocks. However, a note for traders that the minimal deposit is quietly high, from 10.000 USD. It is because no leverage is applied.

One more point, according to XM policy, you must put a position with minimum 1 stock and with at least 1 lot. And as you know, 1 standard lot will be 100.000 units, so based on the policy, the minial deposit will be 100.000 USD, not 10.000 USD, for you to proceed a position. This is very important to traders to consider. Although XM could provide thousands of stocks from many countries, but apparently, when no leverage applied, 10.000 USD minimal deposit is still very high, according to our opinion.

Meanwhile, many forex brokers like XTB or ICMarkets also provide stock trading (XTB provides 1.700 stocks) and traders can still enjoy the maximum leverage of 1:20. Therefore, frankly speaking, this Share account of XM will have difficulty to compete with XTB or ICMarkets.

We have some notes for you to pay attention on XM accounts

As XM is providing 4 account types, so it allows traders to open 8 account types. So it also has a policy with regards to inactive account.

According to XM, an inactive account is defined when there is no transactions of trading/withdrawn/deposit/internal transaction/creating more account in 90 days. In such case, all commission, XMP points will be delete from in active account.

Inactive account will be charged for 5 USD/month, or all account balance if it is less then 5 USD. If accounts have 0 balance, they will be deactivated after 90 days.

Therefore, if you already open many accounts and don’t use them all, you should withdraw from inactive accounts to save monthly charge, or you should transfer them to the ones you usually use to trade.

If you want to open a XM account, please click on the below:

TraderMustRead

.PNG)