It is extremely hard to believe that the price of any good can be negative in reality. But that is what happened with oil prices today.

COVID-19 has driven social distance, factories shutwdown and prevented people from traveling. Global economy is declining.

The pandemic also reduced global oil demand by 29 million barrels a day (compared to about 100 million barrels a day in 2019). OPEC and other producers agreed to cut production by 9.7 million barrels a day. But that supply was still slower than the demand, which led to a large oil surplus in the market and no buyers.

Oil storage capacity is rapidly depleted. Many oil importing countries are storing large quantities of oil, taking advantage of cheap prices to "speculate" oil.

Some oil producers, in the hope of maintaining their market share, have stored excess oil at sea, hiring oil tankers at high costs. Some are believed to be paying more than $ 100,000 per day for each tanker.

So, how can oil prices in Alberta, and even future prices for West Texas Middle (WTI) be negative?

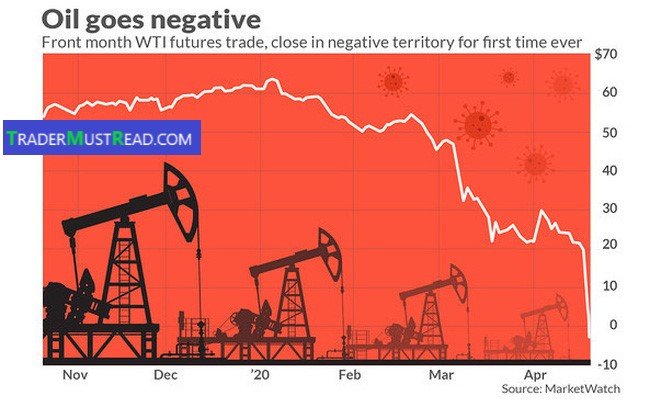

The event started with a fall in futures prices for WTI (futures prices - that is, oil will be traded after a few months at today's prices). This price fell 6 USD / barrel on Monday, reaching the threshold of 11.66 USD. But by the end of the day, the price of the WTI contract in May fell into - $ 37, when buyers were simultaneously selling before the oil was actually delivered and had nowhere to store.

But Alberta oil, primarily derived from oil (called Western Select), is usually sold at $ 10-15 less than the price of WTI, because it must be extracted from shale terrain. That makes the extraction more difficult, and it must also be transported thousands of kilometers to American refineries.

And so the price of oil in Alberta is negative, because the current benchmark price is lower than the cost of production, transportation and storage.

This situation could not last for long. Manufacturers, in short, can accept prices below their variable costs as long as they can pay some fixed costs.

As time goes on, more and more rigs will stop working (technically, a few will be maintained to avoid being compromised) and a new balance between supply and demand will be established. at prices that exceed the average total cost. But this is not good for both Alberta and the United States.

Alberta oil is currently the damage of the oil war between Russia and Saudi Arabia, with COVID-19 exacerbating that situation. Either of these factors may have disrupted Alberta oil production. But the animosity between Russia and Saudi Arabia combined with the global pandemic has been proven catastrophically for Canada and the US energy industry may face with similar situation.

Russia and Saudi Arabia rely heavily on oil revenues to sustain their economies. Of course, the Saudi economy is less diverse than the Russian economy, but both have oil revenues that account for a very high proportion of their GDP (Saudi Arabia is about 50%, Russia 38.9). %), as well as in budgets (Saudi Arabia 87% and Russia 68%) and exports (Saudi Arabia 90% and Russia 59%). It is hard to believe what either of these two countries could do at such a low price.

Russia needs a price of 60 USD / barrel to balance the government budget and even a higher price to remain the current import and export balance.

Saudi Arabia, still the lowest-cost oil producer in the world, can only make money when the price per barrel is over $ 20. Russia must be the price of 40 USD.

But that is still not enough. Saudi Arabia needs $ 80 per barrel to balance the budget, realize plans to diversify the economy and maintain the flow of subsidies to the economy. Besides, the balance also plays an important role in stabilizing the political system of Russia and Saudi Arabia.